This week, Airbnb took us back to our childhoods by listing a Barbie-themed hot-pink DreamHouse mansion in Malibu. In a promotional tie-in for the soon-to-be-released comedy starring Margot Robbie and Ryan Gosling, two fortunate applicants will score a free two-night stay in the iconic dollhouse. But while Airbnb pulls at our nostalgic heartstrings with these playful promotions, two competing tweet threads are painting a more contentious picture of the vacation rental giant’s state of affairs.

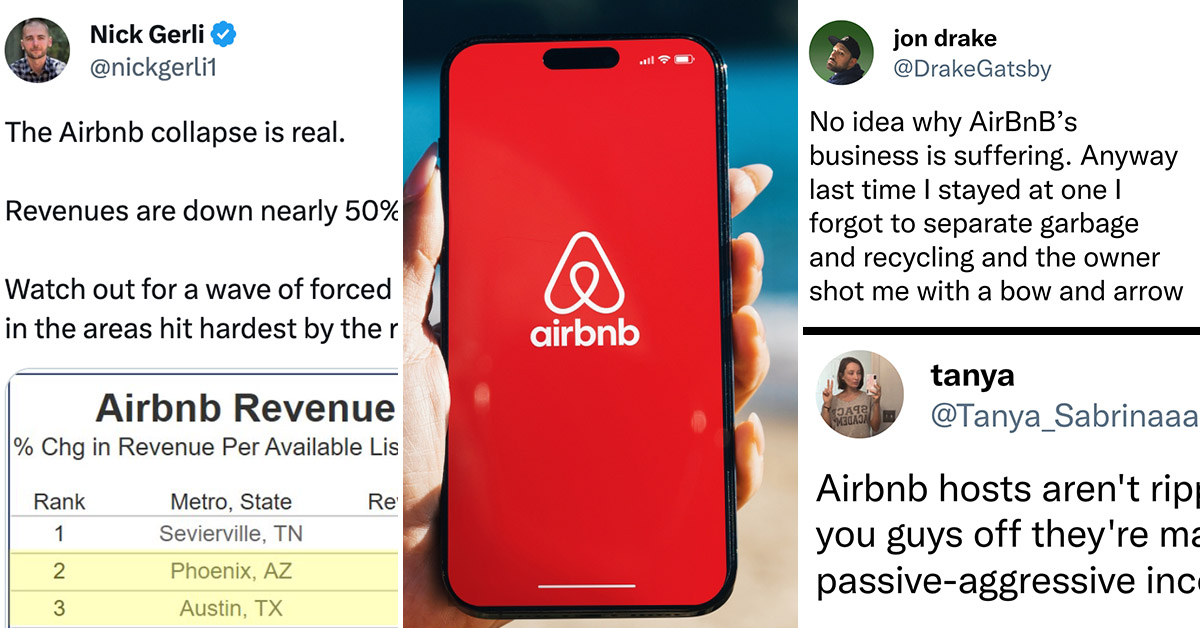

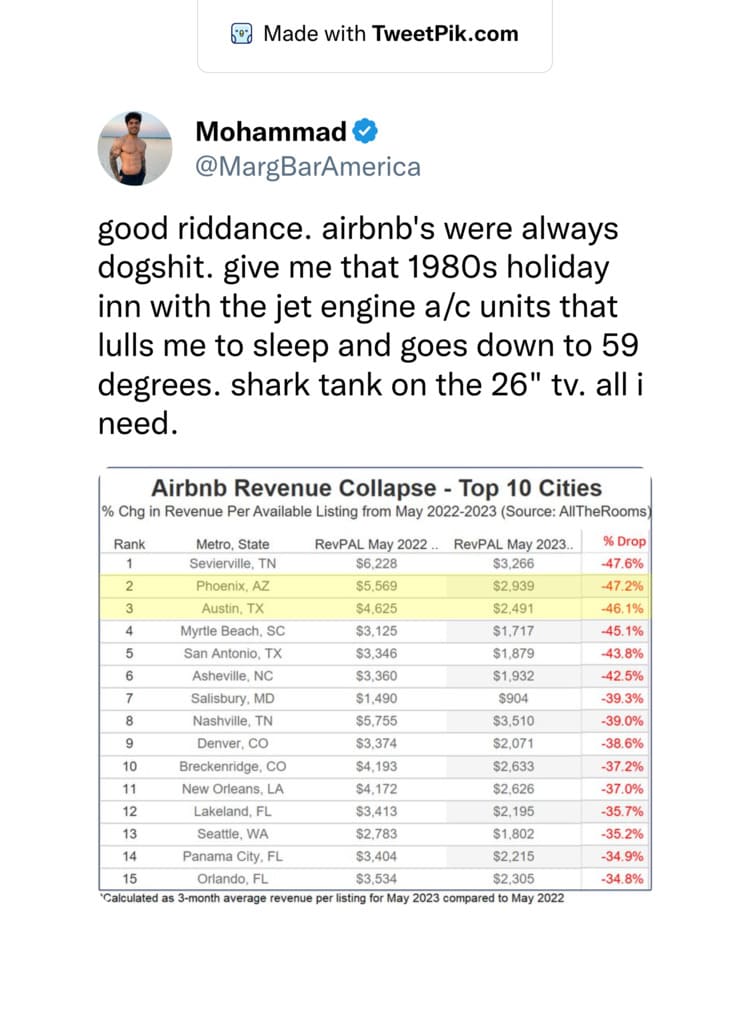

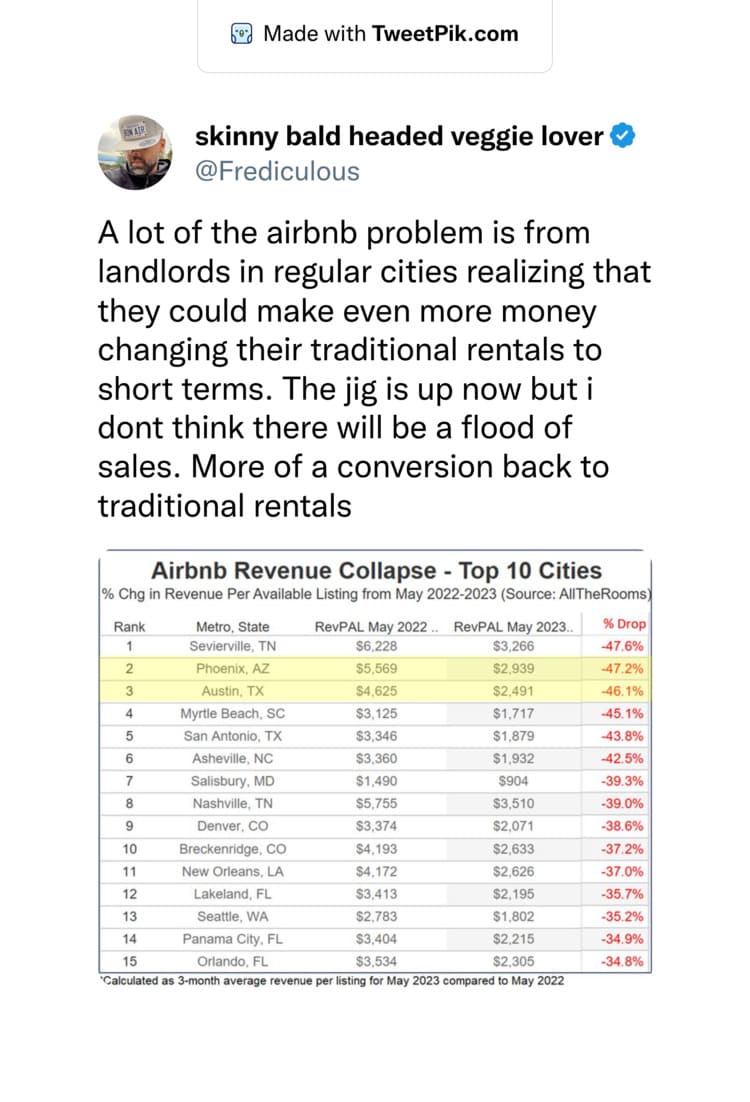

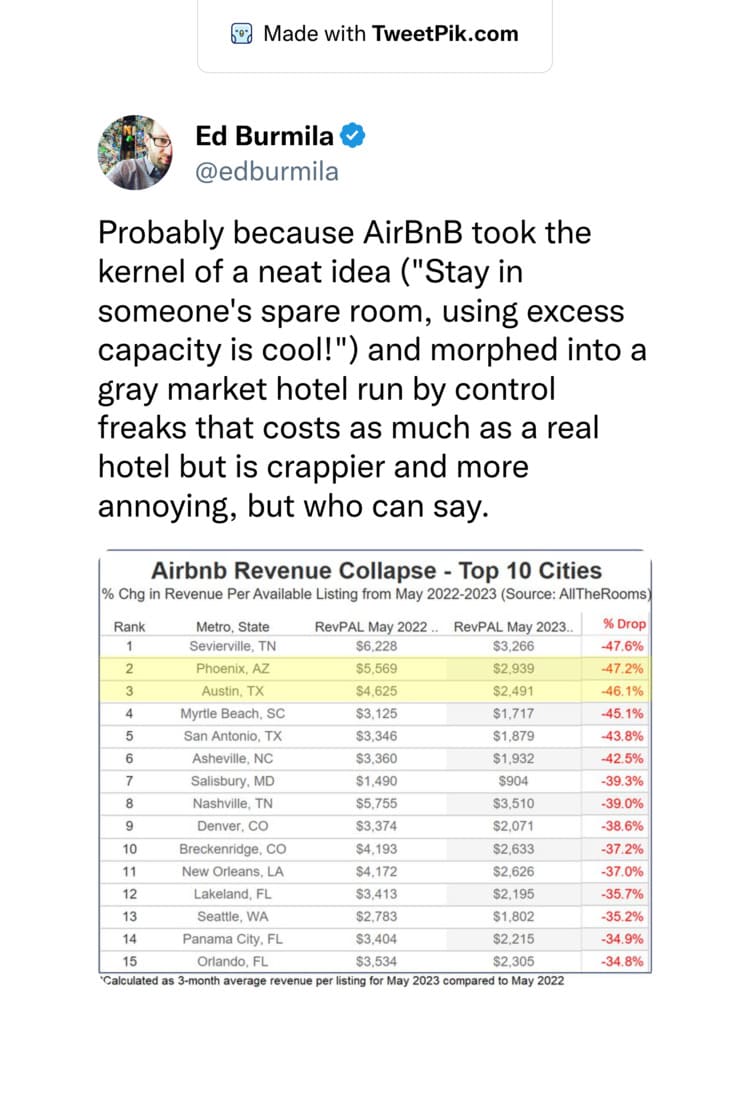

In one corner, we have Nick Geril, CEO of Reventure Consulting. Geril recently tweeted data from AllTheRooms that suggest a near 50% drop in revenue per available listing (RevPAL) in a few key major U.S. cities like Austin and Orlando. According to the data, in Geril’s chart Sevierville, Tenn., saw the most significant decline at 47.6%, while Florida destinations Panama City and Orlando saw nearly 35% drops. Geril linked this data to the U.S. housing market, suggesting a “huge home price downside” if Airbnb hosts, feeling the financial pinch, opt to sell their properties. He also forecasted a potential “cocktail for massive forced selling,” particularly in cities like Phoenix, which boasts more short-term rentals than properties for sale.

The Airbnb collapse is real.

Revenues are down nearly 50% in cities like Phoenix and Austin.

Watch out for a wave of forced selling from Airbnb owners later this year in the areas hit hardest by the revenue collapse. pic.twitter.com/xjGkj7bFC5

— Nick Gerli (@nickgerli1) June 27, 2023

AllTheRooms data, supplied by Nick Geril:

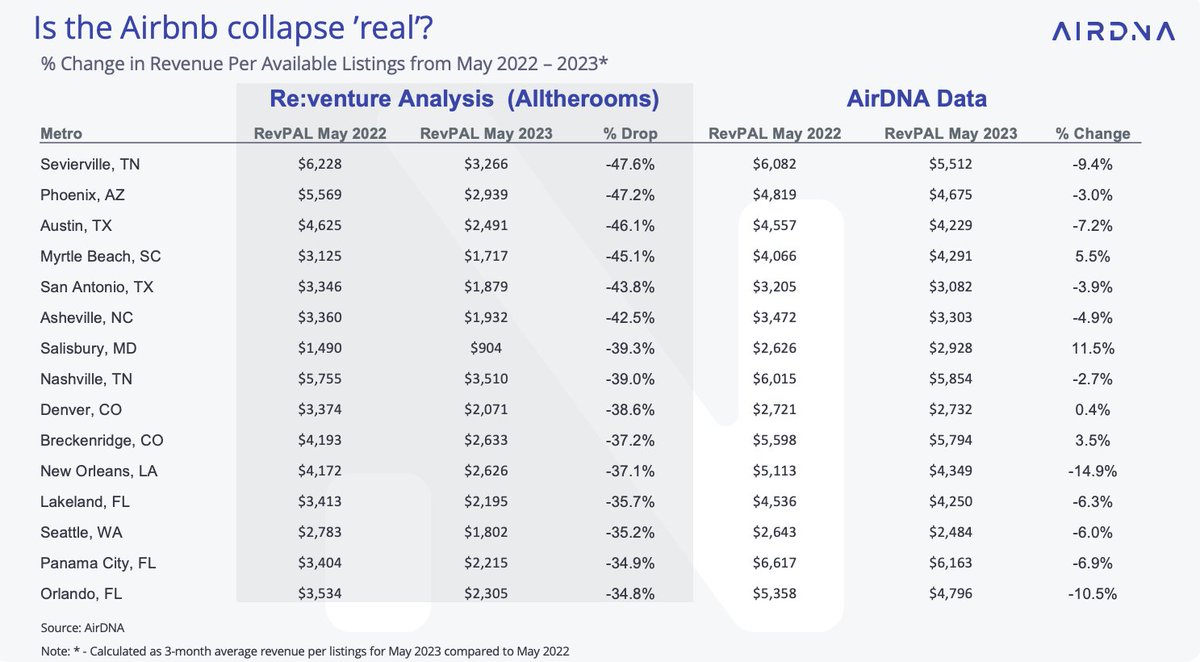

But in the other corner, Jamie Lane, Chief Economist and SVP of Analytics at AirDNA, a short-term-rental data agency, counters Geril’s numbers. According to Lane, Sevierville’s RevPAL decline was only 8.4%, a stark contrast to Geril’s 47.6%. But why are these data sets so different? That’s a question Lane left unanswered, further fueling the debate and piquing our curiosity.

A viral tweet about STR data! Lets get some facts straight… There is not a collapse in RevPAL happening. Is it down in 2023? YES. Is it down 40%? NO.

I've pulled the numbers from @airdna 's dataset mirroring the analysis done by @nickgerli1 . What do we find? The average… https://t.co/DzDc3OjtJ1 pic.twitter.com/FrYt0pMzcl

— Jamie Lane (@Jamie_Lane) June 28, 2023

Let’s be clear. Personally, I’ve grown a bit weary of Airbnb. Its prices seem to be on an endless uptick, and the expectation to scrub toilets and make beds during my stay isn’t exactly my idea of a vacation. However, I can’t deny the business’s underlying value – putting unused spaces to work and offering a unique accommodation experience. And I think it’s selfish and myopic to wish for housing prices to collapse so you can buy a house (a common meme,) when, in reality, the vast majority of homeowners affected would be normal people, not Wall Street fatcats. (Oh, and the idea that AirBNBs have had a massive impact on housing affordability is probably not a reality.)

Airbnb responded to these dueling threads by stating that the data is inconsistent with their internal figures, naturally. The company claims to have seen more guests than ever, with Nights and Experiences Booked growing 19% in Q1 2023 compared to a year ago. Despite a less bullish-than-expected forecast, Airbnb shares have also rebounded this year, nearly recouping losses from 2022.

Meanwhile, Allianz Partners’ recent survey suggested that vacation spending this summer would exceed $200 billion, a 10% increase from 2022, and an incredible 111% increase from pre-pandemic 2019. It’s clear the U.S. consumer is still eager to vacation, shifting spending from goods toward experiences.

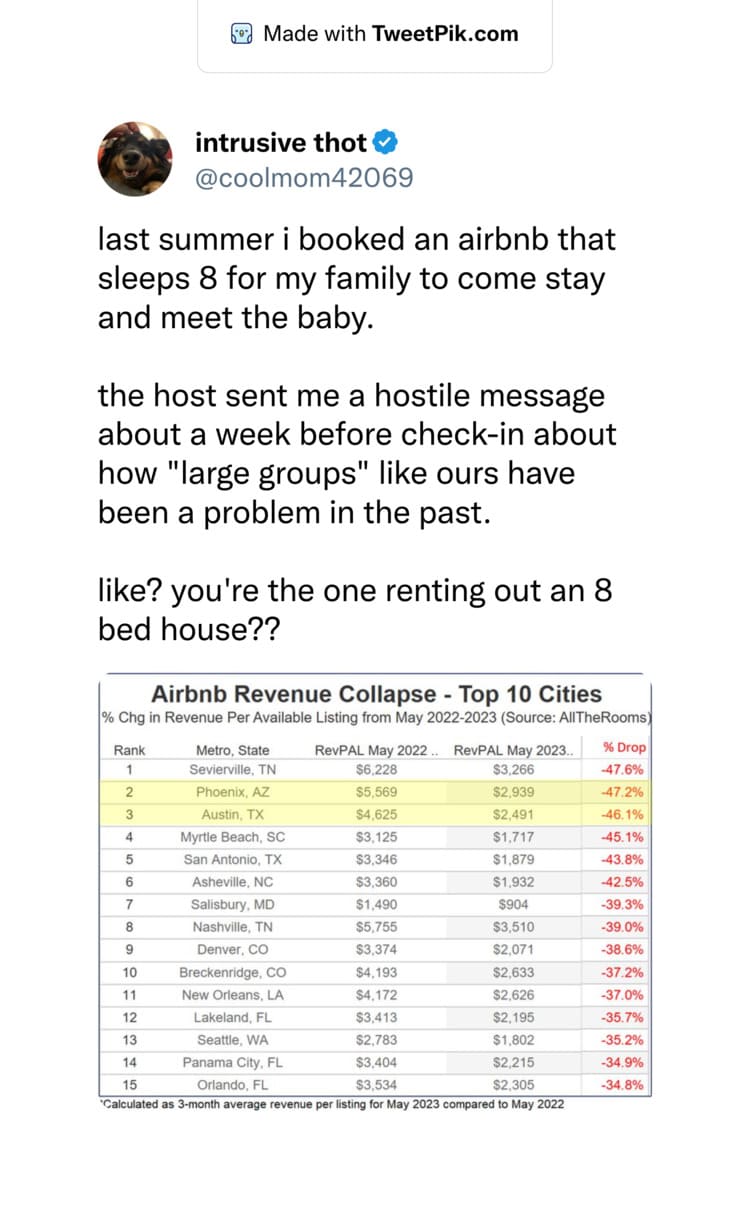

While these threads battle it out, and regardless of whether you’re an Airbnb fan or foe, you can’t deny some of the memes and comments in response to this story are hilarious and worth pondering:

1.

2.

3.

4.

5.

6.

7.

8.

9.

10. But many commenters and analysts were quick to point out, at the very least, these wildly different data sets should be pause for anyone to assume anything about the current state of Airbnb:

11.

12.

13.

So, depending on who you believe, it seems the vacation rental group isn’t quite on the brink of collapse. However, the disparities in data and varying forecasts leave us wondering what the future holds for this pivotal player in the vacation rental market.

But at least the jokes about it will be funny no matter what.