Realtor’s Explanation Of Why Millennials Have Trouble Buying Homes Goes Viral For Its Spot-On Accuracy

In an ever-evolving world marked by unprecedented challenges and shifting economic landscapes, millennials find themselves navigating a formidable obstacle course in the quest to achieve one of the quintessential markers of the American dream – homeownership. As the first generation to come of age in the digital era, millennials are faced with a unique set of circumstances, making the prospect of owning a home seem more elusive than ever before.

Skyrocketing property prices, student loan debts, and a transformed job market have coalesced to create a perfect storm, resulting in a generation grappling with the harsh reality of a seemingly unattainable dream.

Recently, one realtor in Orlando, Freddie Smith (@fmsmith319), shared a now viral video explaining exactly why, in his opinion, millennials are having a hard time buying a home.

https://www.instagram.com/p/CdBot72pzl8/

One commenter asked mentioned, “I can’t get a mortgage. But my rent is 3k.” To which Freddie replied, “Any time a millennial is trying to explain this to a boomer, they use the same example. They go, ‘Well, my interest rates were 15%, you have 6½, you’re so lucky.’ Well, let’s look at it this way.”

“If you bought a house for $80,000 back in the ’80s, a 20% down payment would be $16,000, and the average person was making around $30,000* back then. So your down payment was just half your yearly salary. And then the loan you would have on it would be about $60,000. So in order to pay off the $60,000, if you really wanted to, it’s just two years of your salary, and you could have your house paid off.”

“Well, let’s fast-forward to 2023, and I live in Orlando, so I’ll use this as an example. A $400,000 house with 20% down would cost $80,000 just as the down payment. The average person makes $50,000*, so it’s almost twice their yearly salary just for the down payment. Then they’ve got a $320,000 loan left that they have to look at. That’s nearly seven times their salary to pay off the loan regardless.”

“It is incredibly rare that people are putting 20% down. People are putting 3% to 5% down, which, with the 6% interest rate, is still shooting the mortgage through the roof. The payments on these homes are $3,300 to $3,500 a month on an average, simple three-bed, two-bath home. So that’s the difference.”

@fmsmith319 Replying to @JosiahFuerte

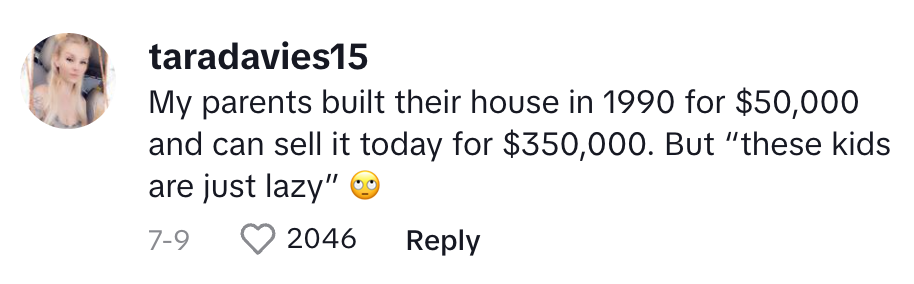

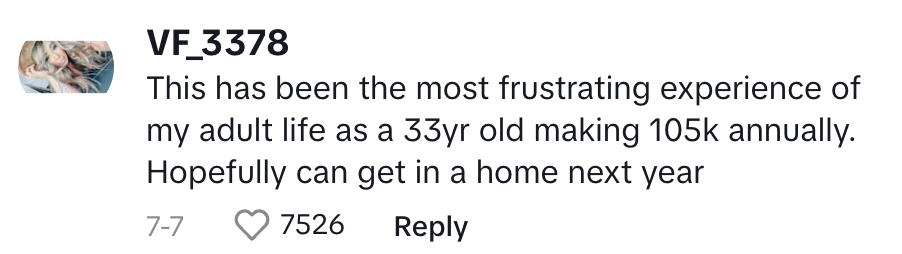

Here’s what people are saying in the comments:

h/t: Buzzfeed