Here’s The Salary You Need To Make To Afford An Average Priced Home In Each State

Ahh, homeownership. A key component of the American dream.

Or at least it used to be.

A recent survey showed that only 13% of millennials across the US figure they will be able to afford a traditional 20% down payment in the next five years. (That’s compared to 34% of wage earners 25 or older, 40 years ago.)

Most of this gap is blamed on millennial student loan debt, and that’s true, but still one of the biggest culprits is home prices. According to the financial management website, HowMuch, home buyers in 2020 are paying almost 39% more than 40 years ago — adjusted for inflation.

That means even full-time employees taking home high salaries are often struggling to budget for their mortgages.

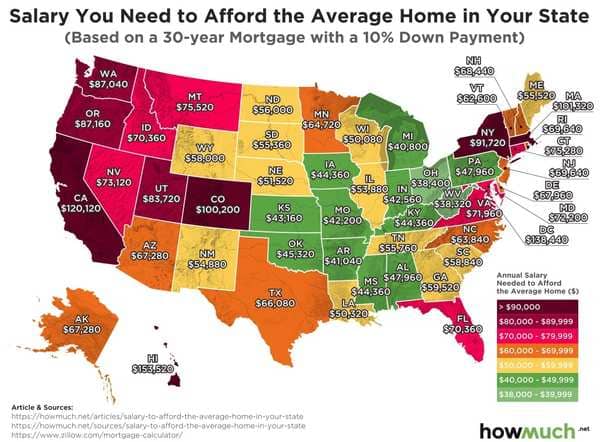

Here’s a breakdown, state-by-state, of just how much of a raise you’re going to need your boss to give you, like yesterday.

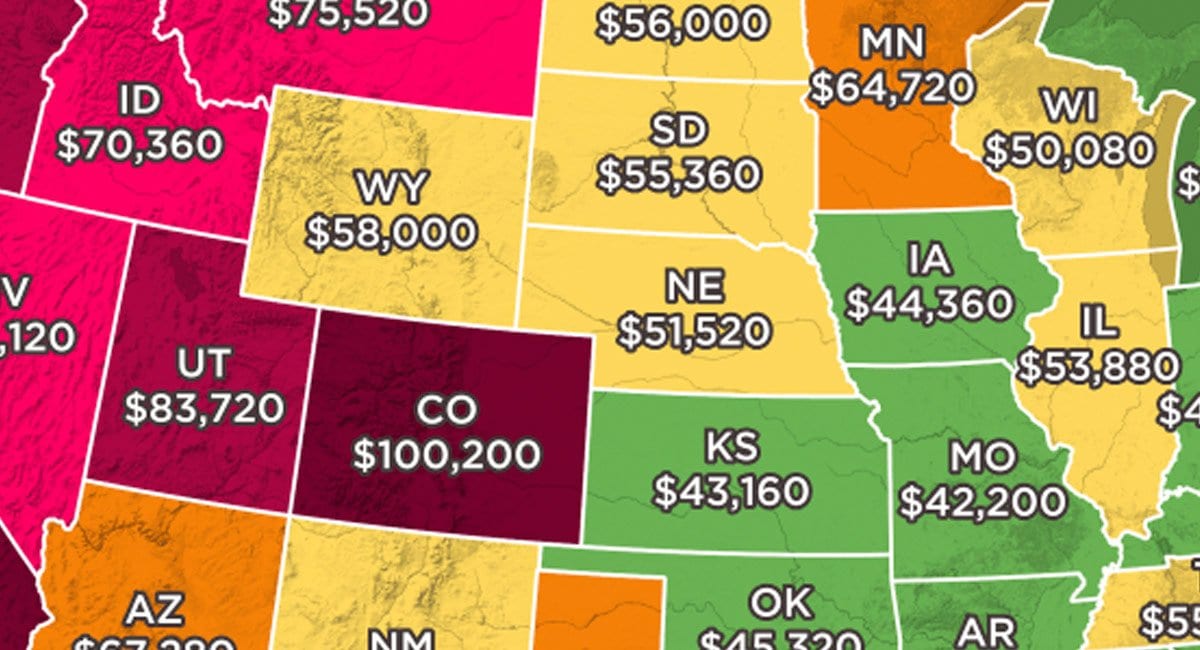

The Pacific Northwest:

Sure, California is nice, but on top of the ~13% income tax, is it really “I need to make $120K/year to even afford a house” nice?

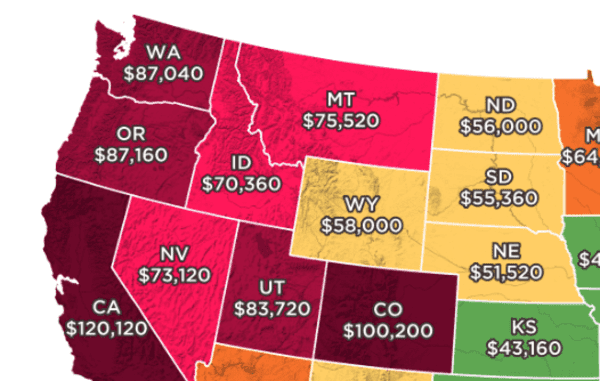

The Northeast & Midwest:

New York probably comes as no surprise to anyone, but what kind of Average Joe is making $103k/year in Massachutesess?

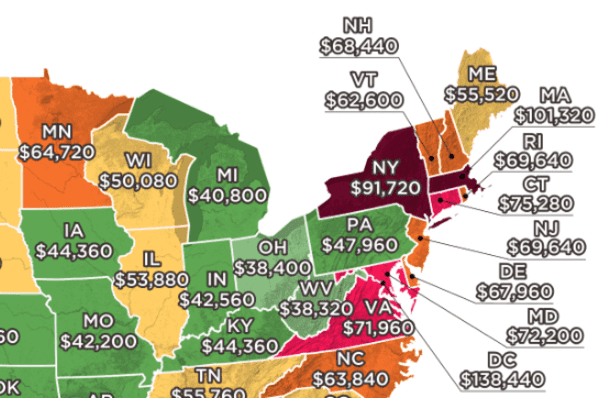

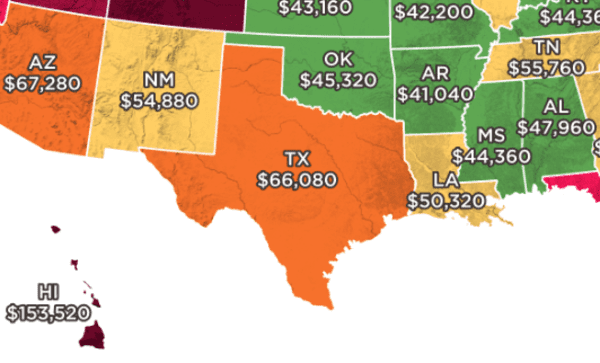

The Southwest:

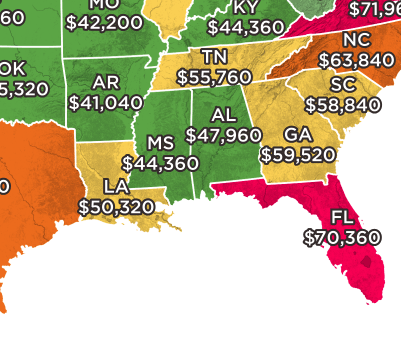

The Southeast:

I guess TL;DR: steer clear of either coast. And seriously think about living in places like North Dakota and Wyoming.

More fun links that may or may not be related:

- Maybe Just Eat At Home Next Time? (22 Annoying Restaurant Customers)

- Unique U.S. Maps To Teach You Everything Geography Class Didn’t (18 Maps)

- Here Are The Most Embarrassing Facts About Each State (50 Pics)

- Math Isn’t Your Strongest Suit, Is It? (25 Pics)

- You Saved Some Money, But At What Cost? (22 Frugal Memes)